If it isn’t already clear that this website is dedicated to investing in properties, particularly overseas properties, and you’re questioning the significance of properties in wealth building, let this serve as a simple guide on why buying property stands as one of the most effective ways to grow your wealth and achieve financial freedom.

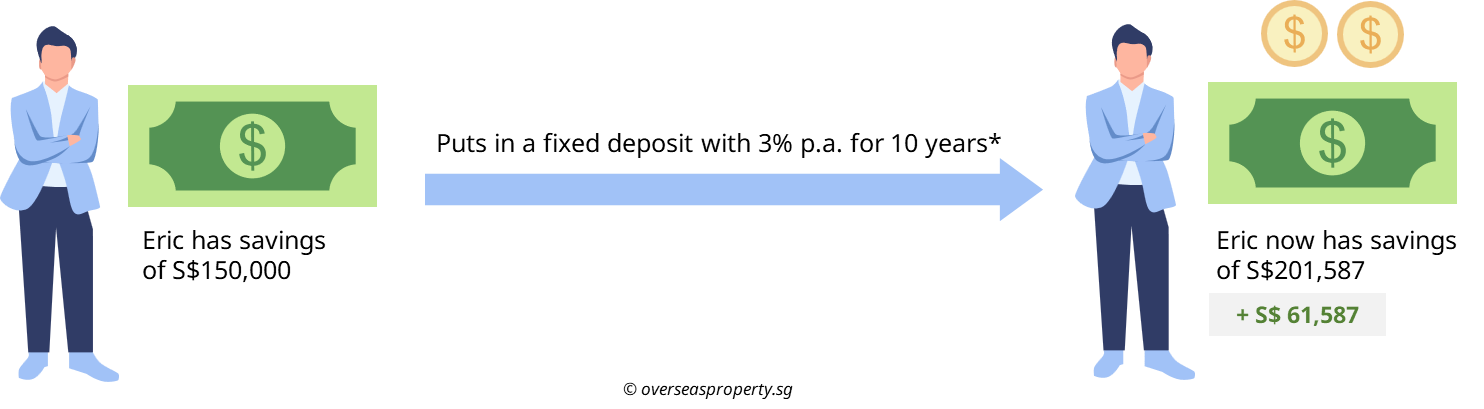

Fundamentally, the conventional approach involves working, earning money, and saving up, with the assumption that placing money in the bank with interest will lead to growth. However, with typically low-interest rates, especially in Singapore, the money tends to grow slowly. Investing the money, on the other hand, can yield higher returns.

The 10-Year Challenge

Let’s consider two scenarios for Eric, who has S$150,000 in savings, and explore the impact of his choices:

Scenario 1 – Putting His Money into Fixed or Term Deposits

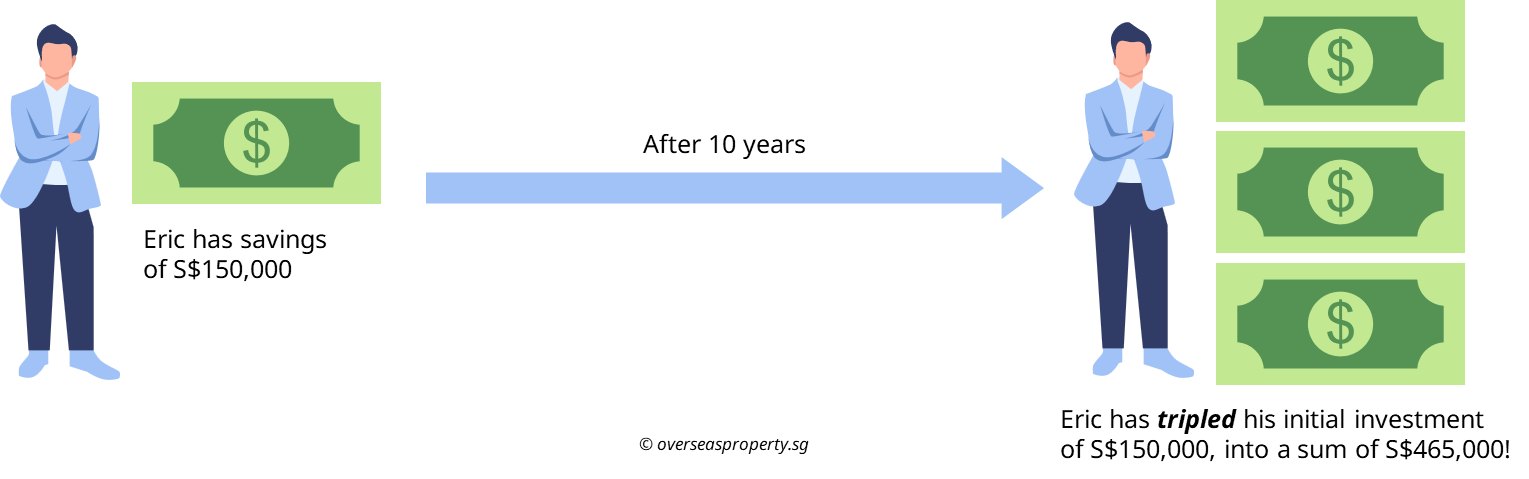

However, what if Eric chose to invest the $150,000 in real estate instead?

Scenario 2 – Investing His Money in Overseas Real Estate

Unable to afford Singapore’s residential market due to high entry prices and additional stamp duties, Eric opts to invest overseas.

By investing in real estate, Eric’s savings of $150,000 more than triples, resulting in a gain of $315,000.

In essence, Eric triples his initial investment of S$150,000, reaching a sum of S$465,000 — that is five times more than if he had left his money in the bank.

The principle of leveraging, coupled with capital appreciation and strategic property management, has significantly grown Eric’s savings over a decade.

Read more: The Singaporean Advantage in Buying New Zealand Properties

The Safety of Property Investments

Property investments are also a safer way to grow your wealth or to park your money, compared to stocks and cryptocurrencies, which are very volatile and more susceptible to market forces.

A property is a physical and tangible product that you can see, touch, live in, and fulfills one of the most basic human needs — a house to live in, a roof over your head. With the exception of extenuating circumstances such as a fire or a natural disaster (which is why insurance coverage is paramount), the property may fluctuate in value but never reduced to zero.

Read more: How to Invest in Overseas Property

We’re Here to Help

This website was created to offer more information on viable overseas property markets and showcase a range of carefully selected properties across different overseas markets that you can consider for your investment portfolio.

If you find yourself in a situation similar to Eric’s, with available cash for real estate investment but limited options in Singapore, feel free to reach out. We can assist you in selecting the right property in the right market to meet your investment goals.